Content

Now, their time can be utilized doing other important financial activities and will typically only step in if there are any discrepancies that need to be investigated. Once a discrepancy has been identified, the business can investigate payments which could have been made by error, or even fraudulently. Thought-leadership articles, blogs, case studies on how to optimize operations, makes processes efficient, reduce costs, be future-ready – Stay abreast with our newsletter.

This is extremely crucial also as a single mistake in reconciliation and bookkeeping can cost a business a large sum of money, make strategies using the wrong financial data, and more. This is a risky practice as it may lead to moving in the wrong direction. On the other hand, https://www.bookstime.com/ enables them to create accurate, frequent cash flow forecasts, plan for the future, make important purchasing decisions, and more. Cash reconciliation can be described as an activity in which the accountants of the company determine the cash movement in the business through reviewing by a company’s ledger. It is essential irrespective of the type of business and is the main concern for the financial institutions.

What Are the Causes for Bank Reconciliations & a General Ledger Not Balancing?

Malcolm’s other interests include collecting vinyl records, minor league baseball, and cycling. The Cash to General Ledger Reconciliation Report lists the subledger transactions that are accounted in GL but they are not reconciled in Cash Management. Built in collaboration with the world’s most innovative banking partners, our pre-defined rules and behaviours give you immediate control of your cash across all accounts and in all geographies. Automation solutions streamline your credit card income and expense reconciliation with minimal effort. After scrutinizing the account, the accountant detects an accounting error that omitted a zero when recording entries. Rectifying the error brings the current revenue to $90 million, which is relatively close to the projection. With automated data feeds, auto-completion, data enrichment, smart matching, MIS and live chat support a cash rec on Fund Recs can be completed with little or no manual intervention.

What Is an Example of Reconciliation in Accounting?

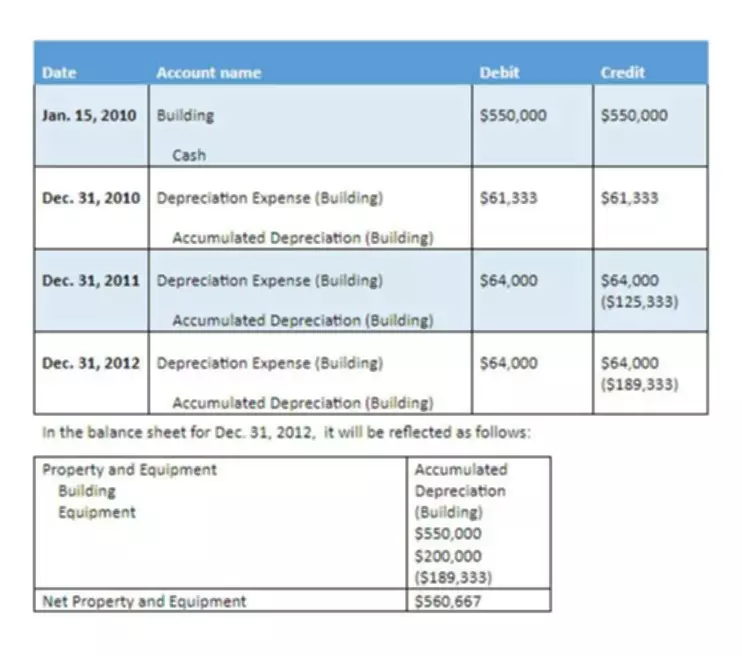

An example of reconciliation would be the purchase of certain assets for a business used to generate revenue and ensuring that the purchase reflects correctly on both the balance sheet and the income statement. The cash used to make the purchases would be recorded as a credit in the cash account and a debit to the asset account.

A revenue recognition system calculates revenue for the current period and liabilities for future deferred revenues. It ingests information from both billing systems and payment processors to perform these calculations according to the company’s arrangements and policies. A cash reconciliation is the process of verifying the completeness of a sale or transaction across the company’s financial systems. Its completion provides assurance for both cash and revenue balances. You should reconcile cash books with statements at the end of every bank cycle.

Reasons for Auditing Cash

The company lodges a complaint with the landlord and is reimbursed the overcharged amount. In the absence of such a review, the company would’ve lost money due to a double-charge. You do not need to have an accounting software to complete a bank reconciliation, but it does make things a bit easier.

Reduce your total cost of ownership with automation that makes the most of staff time and resources. Super-fast processing of the very largest datasets to complete common reconciliation operations in milliseconds. The chances are that your employees will need to have access to cash to make one-off payments every now and again. There are inherent challenges that come along with using petty cash. However, they can be minimised through proper oversight and clear cut best practices. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting.

Importance of Cash Forecasting

A general ledger is a record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. Double-entry accounting is a useful way of reconciling accounts that cash reconciliation helps to catch errors on either side of the entry. In double-entry accounting—which is commonly used by companies—every financial transaction is posted in two accounts, the credit account, and the debit account.

- Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc.

- Identifying the discrepancies early on enhances the potential of identifying the origin quickly, making the necessary adjustments, and moving forward with an accurate cash balance.

- There are inherent challenges that come along with using petty cash.

- The first step is to compare transactions in the internal register and the bank account to see if the payment and deposit transactions match in both records.

- A cash reconciliation is the process of verifying the completeness of a sale or transaction across the company’s financial systems.